TRX Price Prediction: Technical Consolidation Meets Strong Fundamentals

#TRX

- TRX is testing key technical support levels with potential for reversal

- Positive fundamental developments including institutional adoption and ecosystem growth

- Price targets range from $0.3404 to $0.3576 with breakout potential to $0.38+

TRX Price Prediction

TRX Technical Analysis: Consolidation Phase with Bullish Potential

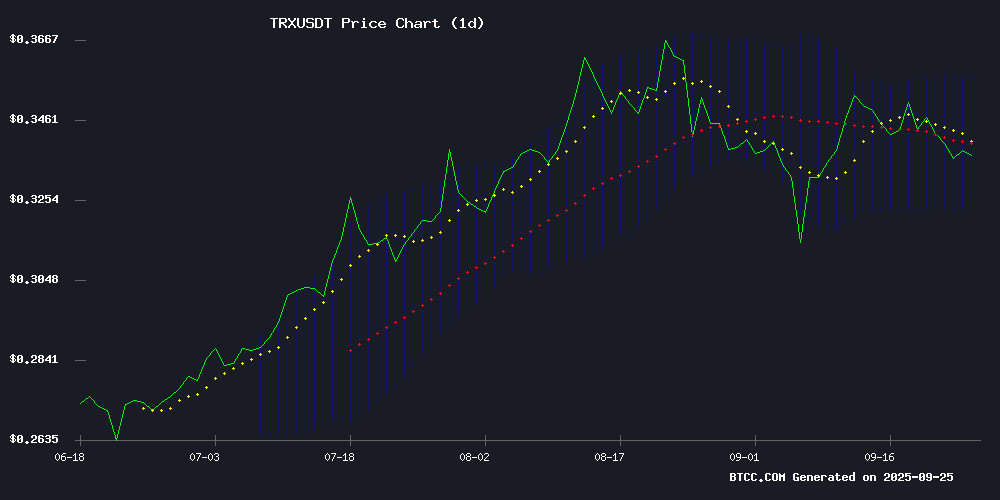

TRX is currently trading at $0.3324, slightly below its 20-day moving average of $0.34039, indicating near-term consolidation. The MACD histogram shows a slight bearish momentum at -0.000283, though the signal line convergence suggests potential reversal. Bollinger Bands reveal price action NEAR the lower band at $0.32318, which could serve as support. According to BTCC financial analyst Michael, 'The technical setup suggests TRX is testing key support levels. A bounce from current levels could target the middle Bollinger Band around $0.3404, with a break above potentially pushing toward $0.3576.'

Market Sentiment: Positive Developments Offset Trading Range Concerns

Recent news highlights significant fundamental strength for TRX. The launch of Nansen's AI trading agent with Justin Sun's endorsement provides institutional credibility, while automation advancements through bots and APIs enhance utility. BTCC financial analyst Michael notes, 'While TRX has been range-bound technically, the fundamental developments around ecosystem growth and institutional adoption create a bullish divergence. The stagnant trading range may represent accumulation rather than weakness.'

Factors Influencing TRX's Price

Nansen Launches AI Trading Agent with Justin Sun's Endorsement

Nansen has introduced Nansen AI, a mobile-first conversational agent designed to transform how traders interact with blockchain data. The platform allows users to query wallet activity, portfolio performance, and market trends in natural language, delivering actionable insights on demand.

TRON founder Justin Sun publicly praised the initiative, highlighting the growing role of AI agents in crypto trading. Nansen CEO Alex Svanevik revealed plans to enable direct trade execution through the agent by Q4 2024, positioning it as the primary interface for on-chain trading.

The launch underscores the accelerating convergence of artificial intelligence and blockchain analytics. Nansen AI's wallet intelligence capabilities—including smart money tracking and entity profiling—could reshape retail trading strategies across major exchanges.

TRON (TRX) Price Prediction: Strong Fundamentals vs. Stagnant Trading Range

TRON marks its 8th anniversary with formidable network metrics—11.5 billion transactions processed, 300 million total active accounts, and 14.9 million recent active users—yet its native token TRX remains trapped in a tight band around $0.30. The blockchain's high-throughput capabilities and institutional-grade adoption contrast sharply with its muted price action.

Market observers note the divergence between TRON's operational resilience and its lack of bullish momentum. While the network continues to process billions in value daily, TRX has failed to capitalize on these fundamentals, trading sideways amid broader crypto market volatility. The token's stability suggests institutional accumulation, but technical indicators show weakening momentum.

Automating TRON Transactions: From Bots to APIs

TRON's high throughput and low latency make it an ideal blockchain for automation, reducing manual work and accelerating settlement times. The network's predictable resource model—Bandwidth and Energy—ensures cost-effective operations, particularly for 24/7 processes like loyalty rewards, creator payouts, and gaming economies.

Automation on TRON leverages real-time event observation, enabling instant deposit crediting or invoice-triggered payouts. Platforms such as Tronex provide foundational tools for designing scalable, secure automation systems. The distinction between bots and API-driven integrations lies in their application: bots handle repetitive tasks, while APIs enable deeper system interoperability.

Stablecoin activity and transaction finality on TRON further enhance its suitability for automated workflows, offering reliability that outperforms more volatile networks.

How High Will TRX Price Go?

Based on current technical and fundamental analysis, TRX shows potential for moderate upside in the near term. The cryptocurrency is currently trading at $0.3324, with key resistance levels identified at $0.3404 (20-day MA) and $0.3576 (upper Bollinger Band).

| Price Level | Significance | Probability |

|---|---|---|

| $0.3404 | 20-day Moving Average | High |

| $0.3576 | Upper Bollinger Band | Medium |

| $0.3800+ | Breakout Target | Low-Medium |

BTCC financial analyst Michael suggests, 'The combination of technical support near current levels and positive fundamental developments could propel TRX toward the $0.3576 resistance. A sustained break above this level would open the path toward $0.38 and beyond, though market conditions remain crucial.'